PACE

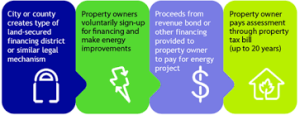

Property Assessed Clean Energy (PACE) programs allow property owners to finance energy-efficient, water-efficient, and renewable-energy projects on existing and, in some cases, new homes through a special tax assessment on the property. The property owner pays the special tax at the same time and in the same manner as all other property taxes.

Property Assessed Clean Energy (PACE) programs allow property owners to finance energy-efficient, water-efficient, and renewable-energy projects on existing and, in some cases, new homes through a special tax assessment on the property. The property owner pays the special tax at the same time and in the same manner as all other property taxes.

PACE looks like a powerful, valuable, exploding program that is here to stay. Realtors will want to understand the program and stay abreast of its evolution.

PACE makes it possible to finance improvements without a down payment. In theory, because the improvement is a fixed asset that stays with the property, sellers may be able to transfer any remaining balance to the buyer when they sell their home. That way, whoever is benefiting from the improvements pays down the loan.

Some lenders do not like PACE – we’ll talk about that. Realtors need to connect with an appropriate lender if they decide to pursue adding PACE to their array of customer options.

Pace Basics

Pace Basics

· Allows funding of energy efficiency, solar, and water conservation.

· Payments are made as part of property taxes.

· Easy to qualify.

· No Fico score.

· Minimum equity in property 10%.

· $5,000 minimum financing – up to 15% of property value.

· Must work with participating contractors.

Why use PACE financing?

· By offering up to 100% financing on qualifying improvements, PACE can eliminate the need to pay out of pocket for an energy-related project.

· Depending upon the type of improvements installed, repayment may be amortized for a period of up to 20 years, keeping monthly payments low enough that utility savings may exceed the payment, creating a net positive cash flow.

· Interest may be tax deductible.

· Because PACE ties the loan to the property and not an individual, the loan may transfer upon sale or refinancing of the property. In other words, owners may not need to be concerned about recouping the cost of their improvements if they decide to sell the property before the loan is repaid.

· A recent study indicates that the value of PACE homes increases more than enough to cover the cost of paying off the lien in the event of a sale. Owners of PACE loans have proven less likely to default than average owners.

Downside to PACE Loans

· PACE may present a hurdle in a real estate transaction. The lien that secures funding is superior to all previously existing private liens, including mortgages. In other words, like property taxes, the PACE special tax assessment will be paid before all other private liens recorded on the property if the property owner defaults on other debt secured by the property. This is changing as the program evolves.

· Some lenders, particularly those involved with federally-insured loans, have balked at PACE because they fear losing money on a foreclosure. They may refuse to finance or refinance a property with PACE. They may demand that the lien be paid off as part of any title transfer. Prepayment can be costly.

· There have been disclosure issues for Realtors. providers have improved the process by helping real estate agents understand how to disclose that there is an additional tax assessment on the property tax bill and how the energy and/or water savings help offset the assessment.

· Interest rate is higher than most consumers anticipate

· Long been promoted that a PACE Lien would transfer with property purchase. That has not been the case in many instances. FHFA initially discouraged PACE liens primarily due to the potential of first lien ahead of a mortgage lien.

History of PACE in California

In California, the first commercial and residential PACE programs were established in 2008. The residential programs soon encountered a significant hurdle. The Federal Housing Finance Agency (FHFA) was concerned that residential PACE assessments had a lien status superior to that of existing mortgages underwritten by Fannie Mae and Freddie Mac. This meant that, in the event of a default, any outstanding PACE assessments (though not the entire amount financed) would be paid off before other liens such as first deeds of trust.

In 2010, Fannie Mae and Freddie Mac stated that they would no longer purchase mortgage loans secured by properties with outstanding PACE loans. This effectively stopped residential PACE programs, with the exception of a few pilot programs.

Since 2010, a number of developments have facilitated a resurgence of residential PACE programs in California – including the passage of state legislation (SB 555), the implementation of legal instruments to address FHFA concerns and disclose the consequence a PACE lien can have on an existing mortgage, and the establishment of a PACE loss reserve program. Many cities and counties now have PACE programs for all three sectors (residential, commercial and municipal).

What can be financed with PACE?

Eligible products vary by individual PACE providers and administrators. In general, most products that can be permanently affixed to a property and reduce on-site electric, gas or water consumption will be considered eligible. Some examples include attic insulation; heating, ventilation and air conditioning replacements; solar photovoltaic and thermal systems; and low-flow toilets.

Often, projects must be performed by a contractor participating in the PACE program to be eligible.

PACE Providers in San Diego County

PACE programs in San Diego county are managed by Renovate America and Ygrene. These organizations facilitate loans with realtors, lenders, clients, and certified contractors.

Renovate America, a San Diego company known for pioneering work and lobbying to improve PACE processes, recently passed the $1B mark in loans. The company, which is the leading provider of residential Property Assessed Clean Energy (PACE) financing in the U.S, and its government partners recently were awarded the U.S. Climate Leadership Certificate for Innovative Partnerships by the U.S. Environmental Protection Agency (EPA). The national award recognizes organizations working collaboratively on leading-edge climate initiatives which reduce greenhouse gas emissions.

Renovate America, which provides loans through it HERO program, provides a team dedicated to supporting real estate professionals working with PACE loans. The nearly 55,000 households in California that have completed HERO projects have contributed to the creation of more than 11,000 local clean energy jobs, while reducing carbon emissions and saving water.

Renovate America, which provides loans through it HERO program, provides a team dedicated to supporting real estate professionals working with PACE loans. The nearly 55,000 households in California that have completed HERO projects have contributed to the creation of more than 11,000 local clean energy jobs, while reducing carbon emissions and saving water.

Renovate America worked with the State of California to set aside a $10 million loan-loss reserve fund to reduce lender’s exposure to defaults. In more than two years of existence, no claims have been made against this fund.

The HERO Program brings together Property Assessed Clean Energy (PACE) financing, consumer protections developed with government partners, more than 5,000 home improvement contractors, and a tech-enabled underwriting and product approval process. The HERO platform enables more than 1 million EPA- and DOE-rated efficient products to be selected if PACE financing is chosen, converting the moment when a homeowner

Y grene offers PACE financing in Chula Vista and throughout most metropolitan areas in San Diego County. Ygrene’s PACE loan is treated the same way as a Mello-Roos. Mello-Roos is a form of financing used by cities, counties, and special districts. These taxes are secured by a continuing lien and are levied annually against property within the district. These liens are subordinate to mortgages.

grene offers PACE financing in Chula Vista and throughout most metropolitan areas in San Diego County. Ygrene’s PACE loan is treated the same way as a Mello-Roos. Mello-Roos is a form of financing used by cities, counties, and special districts. These taxes are secured by a continuing lien and are levied annually against property within the district. These liens are subordinate to mortgages.

For Realtors

Keep your eye on PACE. It looks like attention paid to working out the kinks in the original loan program are paying off.

Recent Comments