What Realtors Need to Know About Solar

As a Realtor, you’ll find yourself increasingly dealing with questions involving solar energy. Whether it’s buyers, sellers, past clients, family or friends, people will look to you for answers to the many questions surrounding “going solar.” In this article we attempt to paint a picture of solar today – the ups and downs – and pay particular attention to what you need to know.

A recent survey showed that more than two-thirds of homeowners plan to make energy-related upgrades to their home in the next year. Many of these homeowners are “going solar.” This number will continue to increase as pressure from government at every level coupled with rising utility rates and an aging housing stock drive homeowners toward solar energy.

Making wise choices about going solar is not easy. Our goal is to help you understand the issues so you can guide your clients to make informed decisions. You’ll be able to ask the right questions and hopefully help them avoid some of the traps that others stumbled into.

We’ll cover five key areas:

• ROI – some homeowners look at solar as an investment – you’ll want to help them pay attention to the risks and rewards of their investment.

• The rest of the house – homeowners who don’t pay attention to what’s happening with energy throughout their home could find themselves fighting physics.

• Lease vs buy – deciding whether to own a solar system or rent it has lasting repercussions.

• Net metering – if you own your solar system, you can make money selling power to your utility company – maybe.

• Resale – you may assume that adding a solar system to a home will increase it’s value and make it easier to sell – be careful.

What homeowners typically look for with solar is the “payback period” – how long it takes to recover their investment. Here are some of the variables involved in this interesting calculation:

What homeowners typically look for with solar is the “payback period” – how long it takes to recover their investment. Here are some of the variables involved in this interesting calculation:

• The cost of the system, installed.

• The cost of maintaining the system over time.

• The amount of electricity you consume.

• The cost of electricity you consume.

• The amount of electricity your system will generate.

• The cost of financing your system.

• The value of any rebates you receive.

• Net metering rules, fees, and benefits.

Besides payback, ROI includes changes to the value of the home and the ease of selling it.

The calculations presented to homeowners have to be much simpler – they can’t take into account all of these factors for several reasons.

• The solar industry and energy industry as a whole are moving – sometimes slowly, sometimes quickly – sometimes in predictable ways, sometimes not. Businesses, utility companies, municipalities, and regulators each play from a different set of beliefs and assumptions. Their power to influence decisions large and small waivers. We simply don’t know what will come next.

• User habits change – the weather changes – the home itself changes. The amount of electricity owners use fluctuates. A family may grow or shrink. They may dial back their thermostat. Extremes of heat or cold seem more frequent. Owners may upgrade windows or add insulation.

• The cost of electricity is rising – we don’t know by how much or when.

• Financing tools are changing constantly. Interest rates vary. Rebates come and go.

• Net metering rules are being hotly contested. One day it looks like the solar industry is winning the battle – the next day belongs to the utilities. We don’t know what tomorrow’s rules will look like and no one can be sure they’ll be grandfathered into today’s rules.

• All of this varies from lender to lender, from municipality to municipality, and from utility company to utility company.

When it comes to factoring ROI into the selling your home, you can’t be sure buyers will want solar, or that they’ll want your system, or the deal you made. You can’t know how your buyer’s lender will treat your solar package – or whether they’ll even allow your deal to pass through.

All of this can seem scary. But, it’s pretty typical for any investment. There are potential risks and potential rewards. The idea is to go into any investment with your eyes open.

You may also want to remind your customers that going solar is only one element of a more energy-efficient home – one that not only saves you money, but one that provides a safer, more comfortable environment. Besides, it’s clear we are moving towards a better energy future, and we can all feel good about participating in that!

Steps Before Solar

If homeowners want to save money and live in a more comfortable home, solar may not be the best first place to look for an upgrade. Most older homes are energy black holes – you pour energy in and it goes everywhere but where you need it. Essentially, you end up heating and cooling the outside rather than the inside of your home.

Here are four places to look for major energy waste:

Here are four places to look for major energy waste:

• Is your home’s shell tight? Is warmed or cooled air flowing through cracks and around doors and windows?

• Is your home’s ductwork tight? Is warmed or cooled air flowing out of leaky ducts before it has a chance to get to your living areas?

• Is your home well-insulated?

• Are your windows energy-efficient?

The fifth place to look – and it’s an important one – is your own habits. Are you wasting energy every day?

The key point is that, if homeowners waste a lot of energy, they need A LOT of solar to offset this waste. On the other hand, if they make their homes energy-efficient first, they can get by with a much smaller solar system. Any way you slice it, this will improve their ROI and reduce their payback time.

There are two things you can do now to gather the information you need to see if there’s anything your customers should do before going solar:

• Get a complete energy assessment. A trained professional can perform tests and gather information to create an energy model of a home. This model can show the effects of various upgrades to consider. You’ll be able to see which upgrades would be most helpful cost-effective.

• Get a monitor for the home that provides real-time data about energy usage. You’ll able to see where energy is going and use this information to modify habits.

Both of these steps will save money.

Net Metering

Net metering allows electric utility customers who connect approved, renewable generation systems such as solar panels to the electric grid to buy and sell electricity to the utility. When homeowners generate electricity from their solar array, it reduces the amount of energy they purchase from their utility company.

This balancing act has come under much attack recently. Net metering was implemented as one of several incentives to kick-start the solar industry. These days, utility companies don’t like the arrangement, arguing that the solar industry is doing quite nicely and no longer needs this incentive, and that customers without solar are bearing an unfair burden of fees for operating the grid. The utility industry is fighting hard to change the rules around net metering.

Net metering is critical to ROI and payback – so critical that in Nevada, where utilities defeated the solar industry and rolled back both the terms of net metering and the rates they had to pay homeowners for their excess electricity, the solar industry quickly dried up.

The ongoing battle over net metering greatly effects the solar market and homeowners with solar systems.

Lease vs Buy

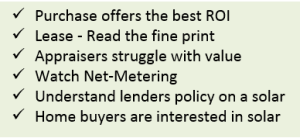

Perhaps the most important issue involving solar is leasing or purchasing the system. Here’s what to watch out for:

Some solar companies push a Power Purchase Agreement – aka lease. When they make their pitch, they tell homeowners what’s in it for them, but they don’t say what’s in it for the solar company. The main advantages of leasing are low out-of-pocket costs and no maintenance. These are really big advantages for some homeowners!

Otherwise, purchasing holds all the cards: 30% tax credit, control, and a 5-10-year ROI. Loans and rebates can further sweeten the pie.

If homeowners lease their system, their utility bills will definitely be lower than SDG&E. If they purchase, they’ll be even lower. And, if net metering continues, a utility company can end up owing the homeowner money on their monthly bill!

But here’s what you should really keep in mind: solar companies that push leases are not really in the business to make a profit on installing solar systems. That’s right. They’re in the business of aggregating power. They own the power their leased systems produce and they sell it back to homeowners. The more leases they do, the bigger players they become in the power industry. They want to be your next utility company.

Buying and Selling a Home with and Existing Solar System

Every existing solar system is unique. It may or may not add value to a home. It may or may not make the home easier to sell.

Evaluating Existing Solar Systems

Evaluating Existing Solar Systems

• Who makes the panels? As the solar industry continues to consolidate, there will be fewer solar manufacturers in five years than there are right now. Make sure the manufacturer is still in business and has a good reputation.

• What’s the warranty? Warranties differ wildly from company to company. Find out how much time remains on the warranty and exactly what’s covered. Many warranties do not cover service, labor, or shipping.

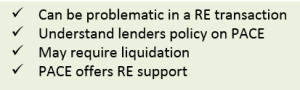

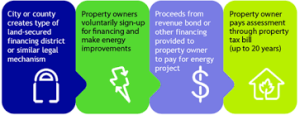

• Is the system leased? If there’s a lease, what are the terms? Is there a fixed rate or a variable rate? (Fixed is ideal.) How easy it is to transfer the existing lease to a new owner.

• How old is the system? Solar technology changes every year. Older systems don’t generate as much energy as newer systems and most systems become less effective as they age.

• Is the system monitored? If so, how many kilowatt hours are produced annually? Ask to see the customer’s annual Net Energy Metering True-up statement, also called a NEM document. This special billing document details how much energy was produced by the home’s solar panels versus what was pulled from the electrical grid. With this statement you can begin to determine the energy value of the solar system.

• The idea of a solar system is to offset existing energy use. Factor in differences in family size and energy needs to keep expectations realistic.

• Has the system been maintained? Cleaning 2-4 times per year is ideal. Has the system been inspected? Inspections from qualified solar technicians cost about $125.

• A bad solar system is a liability.

Determining the Value of an Existing Solar System

A solar system on a roof may or may not add value.

Appraisers struggle to value solar systems. They use comparable sales to determine value instead of ROI or payback. There aren’t a lot of comparable solar systems in your neighborhood and your appraiser probably has little or no training in understanding their value. There is no standard methodology for determining the value of an existing solar system.

Some appraisers are certified as “Green Appraisers.” They’re more knowledgeable about the value of an energy-efficient home. Since appraisers are usually not selected directly, you rely on luck to have a green appraiser working with you.

Like the rest of the solar market, this area is seeing rapid change. There has been some movement in the California state legislature to mandate appropriate training for all appraisers. A growing number of studies are showing that energy-efficiency and solar system do result in higher sales prices and shorter time-to-sell. The movement to include green features in MLS listings is gaining momentum.

Complicating the Sales Process

Buyers may not want to assume and existing solar lease. They may prefer to own their solar system. They may not like the terms of the lease. Terms of the lease may not favor a smooth assumption.

Lenders may not allow a solar lease to pass through to new financing. Some lenders may balk at the perceived value of a solar system when determining loan amounts.

Some lenders are more familiar – and some more comfortable – with the nuances of solar in financing a home purchase.

A buyer or a lender may force a seller to buy out the lease – at terms that are less than favorable. This can make the home more difficult to sell – even negating potential sales in the works.

For Realtors

Your customers look to you to be the experts in matters relating to their homes. We want to help you. That’s why we’re keeping both eyes on the energy-efficiency market. We’ll continue to provide helpful content to you through our enews letters, our website, and our social media sites. If you have any questions, please contact us – we love hearing from you!

Recent Comments